Workshop on Financial Literacy at City Women’s College, Siripur, Bhubaneswar

AFLC in collaboration with Office of Banking Ombudsman, Reserve Bank of India, Bhubaneswar conducted a Workshop on Financial Literacy in City Women’s College, Siripur, Bhubaneswar on 25 November 2017.

AFLC in collaboration with Office of Banking Ombudsman, Reserve Bank of India, Bhubaneswar conducted a Workshop on Financial Literacy in City Women’s College, Siripur, Bhubaneswar on 25 November 2017.

The Program was conducted by D.Mishra, former CGM, RBI , D.D. Mishra, former General Manager of NABARD, M.M. Dash, Manager, Office of Banking Ombudsman , Bhubaneswar. Shreedhar Behera, Banking Ombudsman, Reserve Bank of India was the Chief Guest.

In the workshop, the speakers discussed and provided valuable inputs on importance of budgeting, saving, basics of banking, Credit discipline Going Digital, Cyber Frauds, Grievance Redressal system, Banking Ombudsman Scheme, Financial Inclusion ; explained concepts like compounding of interest, Rule of 72 etc.

A Financial Quiz was conducted. Certificates and books on Financial Education Series published by RBI were given as prizes to 16 award winners. Around 150 students including teachers participated in the Workshop.

AFLC is thankful to Govind Chandra Swain, Founder and CEO, National Student Helpline, for taking initiative in organising the event.

Workshop on Financial Literacy at Indian Institute of Mass Communication (IIMC), Dhenkanal

AFLC conducted a Workshop on Financial Literacy at IIMC, Dhenkanal on 24 08.17. It was a proud moment for AFLC as it conducted the 2 ½ hour program in the Silver Jubilee Year of the Institute.

AFLC conducted a Workshop on Financial Literacy at IIMC, Dhenkanal on 24 08.17. It was a proud moment for AFLC as it conducted the 2 ½ hour program in the Silver Jubilee Year of the Institute.

The Program was conducted by D.Mishra, T.Maharana, and S. Choudhury experts from RBI and NABARD. In the workshop, a video styled “ Why Financial Literacy?” was shown. This basic question put by a business school student in the Seminar on Financial Literacy and Financial Inclusion organised by AFLC in 2016, P. Krishnamurthy, former PCGM , RBI , a panellist did explain brilliantly the need for financial literacy.

In the workshop, the speakers discussed and provided valuable inputs on importance of budgeting, saving, Credit discipline , KYC norms, Currency Management, moving towards “Less Cash” society, Cyber Frauds , Grievance redressal system, Banking Ombudsman Scheme, Sachet website, Financial Inclusion : Informal Lending System and SHG; explained significance of compounding of interest, Rule of 72.

In all, 65 students and 11 officials/ faculty members participated in the Workshop.

(T.Maharana explained SHG scheme and need for financial literacy to its members)

Workshop by Abhyutthana School of Financial Inclusion, Research and Education (ASFIRE)

Promoted by Abhyutthana Group, and launched in the “Seminar on Digital Financial Literacy For All”, on July 24, 2017, in the august presence of Shri A.P. Hota, then Managing Director and CEO of NPCI , ASFIRE, has the proud privilege to conduct a “Workshop on Leadership Challenges for Financial Institutions” in Hotel New Empires, Bhubaneswar on 9 September 2017.Officials from banking, insurance sector, former senior officers from RBI, NABARD, commercial banks, Government of Odisha, NGO etc participated in the day-long Workshop.

Promoted by Abhyutthana Group, and launched in the “Seminar on Digital Financial Literacy For All”, on July 24, 2017, in the august presence of Shri A.P. Hota, then Managing Director and CEO of NPCI , ASFIRE, has the proud privilege to conduct a “Workshop on Leadership Challenges for Financial Institutions” in Hotel New Empires, Bhubaneswar on 9 September 2017.Officials from banking, insurance sector, former senior officers from RBI, NABARD, commercial banks, Government of Odisha, NGO etc participated in the day-long Workshop.

Management and Insurance Guru, Dr K.C. Mishra, Director, Doha Bank, former Director, National Insurance Academy, former Vice Chancellor of Sri Sri University, Cuttack delivered the Key Note address. Dr Mishra covered the various types of leaders, flagged the leadership challenges in new age institutions and advised the participants how to become a successful leader.

The Workshop was conducted by Dr Ashok Mangaraj, Director , BRAINSTAIN, and an experienced financial consultant and National Level trainer in the corporate world, Dr Suchitra Pal, Associate Professor, Organisation Behaviour, Xavier University, Bhubaneswar.

Dr Mangaraj spoke about the managerial responsibilities, key issues in leadership, Decision making, Interpersonal skills, Resource Management, Conflict Management and Stress Management.

Prof (Dr) Suchitra Pal, explained Emotional Intelligence based Leadership and work-life balance and conducted a psychometric test.

Tapan Mishra, a motivational speaker, visiting faculty to Indian Institute of Business Management (Patna), Faculty Member of Art of Living Foundation, International ( so far trained more than 30,000 participants), spoke brilliantly and interacted with the participants.

At the outset, S Choudhury, Member, Advisory Group, AFLC welcomed the guests and participants. D.Mishra, Founder of ASFIRE spoke about the objectives of the institute and gave introduction of the guests.

Eminent and former executives/ senior officers S.K. Mitra, former Executive Director, NABARD, K.R Das, former Regional Director, RBI, Hyderabad, T. Maharana, former CGM, NABARD, RC Das, former CGM, RBI, B.M Patnaik, Coordinator, Odisha Livelihood Mission (OLM), S. Padhi, Government of Odisha, Premananda Dash, Sudarsan Sahu, P..K. Swain former bankers and Deenabandhu Sahu, Managing Trustee Swapna Trust participated.

S.K. Mitra, Adviser , AFLC gave the valediction address. K.R. Das, President , ASFIRE gave away the Participation Certificates.

ASFIRE is thankful to Manoj Satapathy, General , IFFCO Tokio for shaping the outline of the Workshop.

New Launch : Abhyutthana School of Financial Inclusion, Research and Education (ASFIRE)

Promoted by Abhyutthana Group, and launched in the “Seminar on Digital Financial Literacy For All”, on July 24, 2017, in the august presence of Shri A.P. Hota, then Managing Director and CEO of NPCI , ASFIRE, has the proud privilege to conduct a “Workshop on Leadership Challenges for Financial Institutions” in Hotel New Empires, Bhubaneswar on 9 September. Officials from banking, insurance sector, former senior officers from RBI, NABARD, commercial banks, Government of Odisha, NGO etc participated in the day-long Workshop.

Promoted by Abhyutthana Group, and launched in the “Seminar on Digital Financial Literacy For All”, on July 24, 2017, in the august presence of Shri A.P. Hota, then Managing Director and CEO of NPCI , ASFIRE, has the proud privilege to conduct a “Workshop on Leadership Challenges for Financial Institutions” in Hotel New Empires, Bhubaneswar on 9 September. Officials from banking, insurance sector, former senior officers from RBI, NABARD, commercial banks, Government of Odisha, NGO etc participated in the day-long Workshop.

The Seminar was inaugurated by Sri Shreedhar Behera, Banking Ombudsman, RBI, Bhubaneswar, as the Chief Guest.

Management and Insurance Guru, Dr K.C. Mishra, Director, Doha Bank, former Director, National Insurance Academy, Pune, former Vice Chancellor of Sri Sri University, Cuttack delivered the Key Note address. In his illustrious career spanning over three decades, Dr Mishra was also Director, Lal Bahadur Shastri Institute of Management, Delhi and was Member of Planning Commission Sub Group on Weather Insurance for Agriculture. In his eloquent and erudite speech, Dr Mishra covered the various types of leaders, flagged the leadership challenges in new age institutions and advised the participants how to become a successful leader.

The Workshop was conducted by Dr Ashok Mangaraj, Director , BRAINSTAIN, and an experienced financial consultant and National Level trainer in the corporate world, Dr Suchitra Pal, Associate Professor, Organisation Behaviour, Xavier University, Bhubaneswar.

Dr Mangaraj spoke about the managerial responsibilities, key issues in leadership, Decision making, Interpersonal skills, Resource Management, Conflict Management and Stress Management.

Prof (Dr) Suchitra Pal, explained Emotional Intelligence based Leadership and work-life balance and conducted a psychometric test.

Shri Tapan Mishra, a motivational speaker, visiting faculty to Indian Institute of Business Management (Patna), Faculty Member of Art of Living Foundation, International ( so far trained more than 30,000 participants), Motivational Trainer in DRDO, HAL, NALCO, BSNL, SAIL etc spoke brilliantly and interacted with the participants.

At the outset, S Choudhury, former General Manager, RBI, Member, Advisory Group, AFLC welcomed the guests and participants. D.Mishra, Founder of ASFIRE spoke about the objectives of the institute and gave introduction of the guests.

Eminent and former executives viz,. S.K. Mitra, former Executive Director, NABARD, K.R Das, former Regional Director, RBI, Hyderabad, T. Maharana, former CGM, NABARD, RC Das, former CGM, RBI, B.M Patnaik, former General Manager , NABARD and State Coordinator, Odisha Livelihood Mission (OLM), Satyabrata Padhi, Government of Odisha, Premananda Dash , former DGM, Canara Bank, Sudarsan Sahu, a former banker and Deenabandhu Sahu, Managing Trustee Swapna Trust participated.

ASFIRE is thankful to Manoj Satapathy, General , IFFCO Tokio for shaping the outline of the Workshop.

S.K. Mitra, Adviser , AFLC gave the valediction address. K.R. Das, President , ASFIRE gave away the Participation Certificates.

ASFIRE places on its record a deep sense of appreciation and likes to thank Deenabandhu Sahu (a former official RBI) and Managing Trustee, Swapna Trust for promptly placing a brief report on the event on its Face Book Group.

AFLC conducted a Workshop on Financial Literacy at IIMC, Dhenkanal.

AFLC conducted a Workshop on Financial Literacy at Indian Institute of Mass Communication ( IIMC), Dhenkanal on 24 August 2017. It was a proud moment for AFLC as it conducted the 2 ½ hour program in the Silver Jubilee Year of the Institute.

AFLC conducted a Workshop on Financial Literacy at Indian Institute of Mass Communication ( IIMC), Dhenkanal on 24 August 2017. It was a proud moment for AFLC as it conducted the 2 ½ hour program in the Silver Jubilee Year of the Institute.

The Program was conducted by D.Mishra, former CGM, RBI , Shri T.Maharana, former CGM, NABARD and Shri S. Choudhury , former General Manager of RBI.

At the outset, a video styled “Why Financial Literacy?” was shown. It may be mentioned that to this basic question put by a business school student in the Seminar on Financial Literacy and Financial Inclusion organised by AFLC on 19 March 2016, Shri P. Krishnamurthy, former PCGM , RBI , a panellist did explain brilliantly the need for financial literacy in a society.

In the workshop, the speakers discussed and provided valuable inputs on importance of budgeting, saving, Credit discipline, KYC norms, Currency Management, moving towards “Less Cash” society, Cyber Frauds , Grievance redressal system, Banking Ombudsman Scheme, Sachet website, Financial Inclusion : Informal Lending System and SHG; explained significance of compounding of interest, Rule of 72.

In all, 65 students and 11 officials/ faculty members participated in the Workshop.

A Souvenir brought out by AFLC on 24 July 2017, during the “State Level Seminar on Digital Financial Literacy for All”, covering useful, informative articles on banking, finance and brochure on BHIM ( published by NPCI) were distributed to participants.

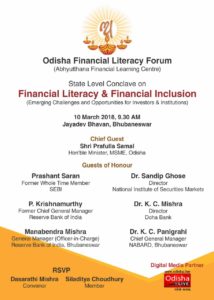

‘Odisha Financial Literacy Forum advocates Digital Financial Literacy of Common People’

Odisha Financial Literacy Forum, a state level body, engaged in educating people on financial inclusion organised their 2nd annual seminar to disseminate knowledge on digital banking comprising e-banking, pre paid instruments, e-wallet, mobile banking, Aadhaar-based payment system, regulatory framework etc.

‘As digital banking opens new vistas, cyber security would be a challenge for all stake holders. The bankers and users need to be sensitised about the digital transactions mentioned Dasarathi Mishra, Managing Partner, AFLC.

Officials from banks, insurance companies, MFIs, MSME sector, banking regulators, Government and students of business schools/universities participated in the seminar and conversed about the changing scenario focusing on digital financial literacy.

Dr. A. S. Ramasastri, Director, Institute for Development and Research in Banking Technology, Hyderabad, Shri P. Krishnamurthy, former PCGM, RBI, Dr. K. C. Mishra, Management Expert and Director of Doha Bank as well as former Vice Chancellor of Sri Sri University, Shri S. K. Mitra, former Executive Director, NABARD, Shri P. K. Panda, Principal, CAB, RBI, Pune, Shri R. N. Dash, former Regional Director, Reserve Bank of India, Hyderabad and Shri Shreedhar Behera, Banking Ombudsman spoke in the occasion.

The Seminar aimed to dwell upon the financial inclusion initiatives of Government and RBI, emerging dimensions of financial literacy and inclusion by banking and insurance sector, consumer protection and grievance redressal mechanism available to the citizens.