Seminar on Investor Awareness Programme under aegis of SEBI-IPEF 12 March 2021 ( 4.00 PM -6.00 PM)

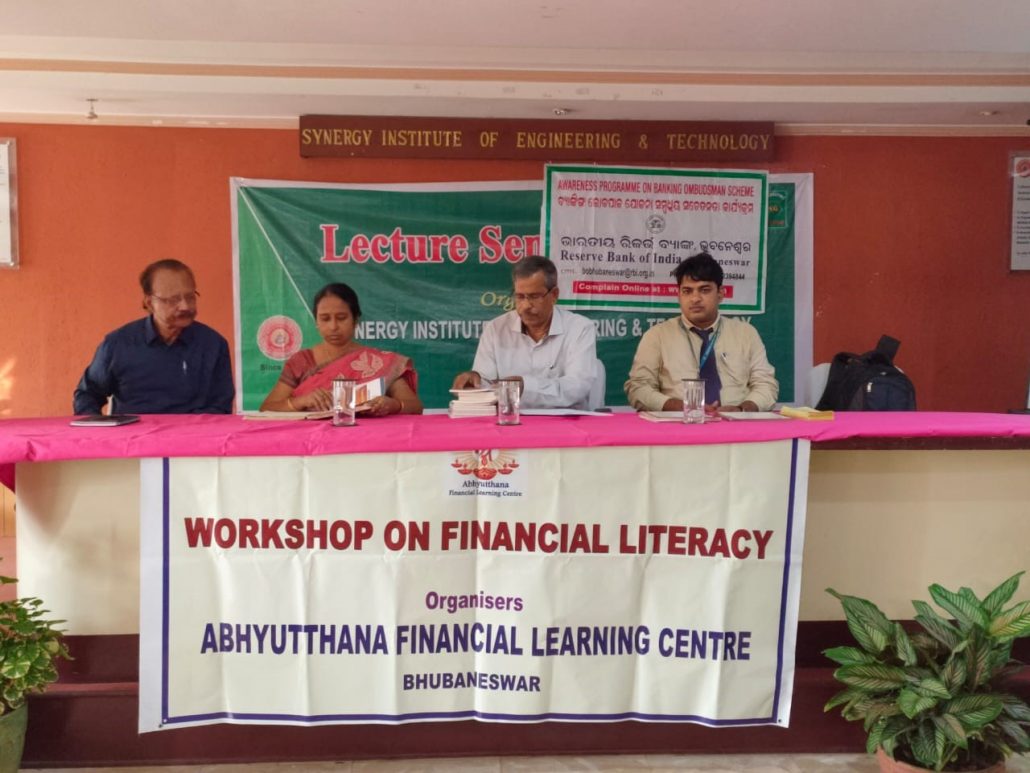

We have the pleasure in informing that Abhyutthana Foundation Charitable Trust , Bhubaneswar organized a Seminar on “ Securities Market- Challenges and Opportunities- Role of SEBI as a regulator” on 12 March 2021 ( 4.00 PM -5.30 PM) in the PG Council Hall, Utkal University campus, Vani Vihar , Bhubaneswar.

In the beginning, Shri D Mishra, Managing Trustee welcomed the guests and articipants and introduced the Guests.

The Seminar was addressed by senior executives of Securities and Exchange Board of India ( SEBI), Mumbai : Shri S K Mohanty, Whole Time Member and Shri G P Garg, Executive Director. Shri Mohanty spoke on “ Securities Market : Challenges and Emerging Opportunities: Role of SEBI in promoting and regulating securities market”. Shri Garg made a presentation on “Innovation Sandbox and Data Science in Capital Market”.

Prof ( Dr) Basant Kumar Mallick , Chairman, PG Council, Utkal University graced the event as Chief Guest. Prof ( Dr) Anil Swain , former Professor and Head of Department, Department of Commerce, Utkal University presided over the function. He also summed up the proceedings of the Seminar .

The distinguished participants included : Dr Sandip Ghose, former Chairman, NISM, Shri T Maharana, former CGM, NABARD, Shri RC Das, former CGM, RBI, Shri S Choudhury, Former GM, RBI, Shri Debaraj Mishra, Former General Manager, Utkal Gamin Bank.

In all, 81persons participated (mostly students of the Utkal University, XIMB) . Of the participants, 52 joined the Seminar in physical mode maintaining social distance and 29 in the on line mode.

( D Mishra)

Convener

15.03.2021`