Conclave on ‘Financial Literacy and Financial Inclusion’ organized by AFLC

- Educated society is the largest contributor for the socio-economic development of the country

- India needs more financially included population to make the banking system robust

- Financial literacy is required to safeguard people against fraudulent schemes

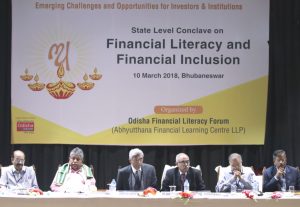

“Any kind of literacy, including financial literacy plays a vital role for the development of the society. And particularly educated society is the largest contributor for the socio-economic development of the country” opined Prafulla Samal, Minister for MSME, Odisha today. He was addressing the State level Conclave on ‘Financial Literacy and Financial Inclusion’ organized by Odisha Financial Literacy Forum, promoted by Abhyutthana Financial Learning Centre AFLC here at Jayadev Bhawan.

The Conclave vividly deliberated on emerging challenges and opportunities for investors and institutions in financial inclusion process. The inaugural session was attended by dignitaries like Prashant Saran, former Whole-Time Member, SEBI, P. Krishnamurthy, Former Chief General Manager, RBI, Dr. K. C. Mishra, Director, Doha Bank, Dr. and Manabendra Mishra, General Manager (OIC) RBI, Bhubaneswar.

“Government has made all official transactions through Bank only. So, people have to learn the Banking procedures and regulations well. Mere literacy will not help much, it needs more and more financially included population to make the system robust” said Dr. Sandip Ghose, Director, National Institute of Securities Markets (NISM), Mumbai.

The conclave was attended by leading brains of Financial Sector, Banking Sector Officials, Academia, Insurance, Mutual Funds Experts, MSME Entrepreneurs, Delegates and Students from reputed Business Schools.

“To empower society through financial literacy with special emphasis on youth, women and small income groups is AFLC’s vision. The conclave is a step further in our endeavor to impart financial education to people and safeguard against fraudulent policies and schemes” said Dasarathi Mishra, Founder and Managing Partner, AFLC.

The conclave held prominence in the backdrop of the ‘National Strategy for Financial Education of Government of India, 2009’, which stresses the need on financial education for furthering financial inclusion and inclusive growth.

Among others, Shiv Mishra, Deputy Vice President, IDBI Capital Services, Mumbai, S. K. Mitra, Former Executive Director, NABARD, K. R. Das, Former Regional Director, RBI, Hyderabad, Officials from Central Depository Services Ltd. and Nirmal Bang Securities Ltd., Kolkata and Siladitya Choudhury, Former General Manager, RBI also graced the occasion.

Odisha Financial Literacy Forum, promoted by Abhyutthana Financial Learning Centre LLP (AFLC) is going to organize a State level Conclave on Financial Literacy and Financial Inclusion on 10th March 2018 at Jayadev Bhawan, Bhubaneswar. The daylong conclave is set to deliberate on ‘Emerging Challenges and opportunities for Investors & Institutions.’

Odisha Financial Literacy Forum, promoted by Abhyutthana Financial Learning Centre LLP (AFLC) is going to organize a State level Conclave on Financial Literacy and Financial Inclusion on 10th March 2018 at Jayadev Bhawan, Bhubaneswar. The daylong conclave is set to deliberate on ‘Emerging Challenges and opportunities for Investors & Institutions.’ “To empower society through financial literacy with special emphasis on youth, women and small income groups is AFLC’s vision” said Dasarathi Mishra, Founder and Managing Partner, AFLC.

“To empower society through financial literacy with special emphasis on youth, women and small income groups is AFLC’s vision” said Dasarathi Mishra, Founder and Managing Partner, AFLC. “The conclave holds prominence in the backdrop of the National Strategy for Financial Education of Government of India, 2009 which stresses the need on financial education for furthering financial inclusion and inclusive growth. It’s a step further in our endeavor to impart financial education to people and safeguards against fraudulent policies and schemes”, Shri Mishra added.

“The conclave holds prominence in the backdrop of the National Strategy for Financial Education of Government of India, 2009 which stresses the need on financial education for furthering financial inclusion and inclusive growth. It’s a step further in our endeavor to impart financial education to people and safeguards against fraudulent policies and schemes”, Shri Mishra added.