WORKSHOP ON FINANCIAL LITERACY- INDIAN INSTITUTE OF MASS COMMUNICATION

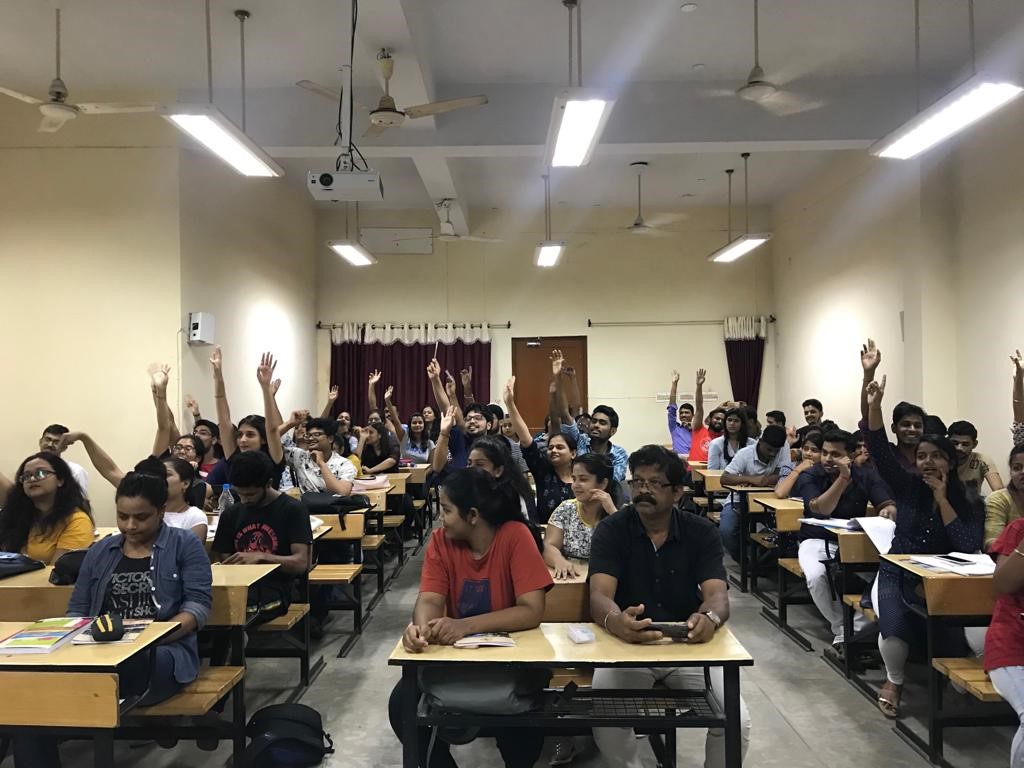

AFLC conducted a Workshop on Financial Literacy at Indian Institute of Mass Communication, Dhenkanal on 18 September 2019. At the outset, Prof (Dr) Mrinal Chatterjee, Head of the Institute welcomed the guests and emphasised the supreme importance of financial literacy in our society.

D.Mishra, Founder and Managing Partner, AFLC briefly explained the objectives and activities of AFLC and how it is committed to bring transformation in the society. He gave an outline of the financial canvass, banking structure, deposit insurance, regulation of banks in India.

S Choudhury, former General Manager , Reserve Bank of India briefly explained the functions of the central bank ( RBI) and the monetary policy, instruments of monetary control, (Repo Rate, Reverse Rate, CRR, SLR, etc.), transmission of the policy.

Madan Mohan Dash, Manager, Office of Banking Ombudsman , RBI, Bhubaneswar explained the limited liability on account of digital banking transactions by the bank customers. He explained the grievance redressal mechanism available with the banks and role of Banking Ombudsman in dealing with Complaints in banking system.

A Financial Quiz was conducted by Mr Choudhury. Prizes were distributed to 10 successful participants. In all, 66 students and office staff participated in the workshop.